What's this about?

What's this about?Over the last two and half years complaints about unfair bank charges had been placed 'on hold' by UK banks and the Financial Ombudsman Service (FOS). This was because the UK's financial regulator - the Financial Services Authority (FSA) - had granted a waiver, which resulted in all complaints being frozen pending the outcome of the OFT's bank charges test case.

That waiver was lifted by the FSA after the OFT lost its test case before the UK Supreme Court. Most banks will now tell you that because they won they will not be refunding any bank charges, and that this issue is now closed. For example RBS is now writing to customers advising "we do not believe that there is any other legal basis on which the level of these charges can be challenged". It's untrue and incorrect to suggest that bank charges are 'fair' or cannot be challenged. The OFT lost on an extremely narrow technical point, and a consensus remains that bank charges are legally unfair and excessive.

Importantly, the UK Supreme Court was careful to explain that its judgment did “not resolve the myriad cases that are currently stayed in which customers have challenged Relevant Charges”. In particular, the court made it clear that “it remained open to question whether bank charges were fair” in relation to regulation 5(1) of the Unfair Terms in Consumer Contract Regulations.

What should I do now?

What should I do now? If you have an existing complaint with your bank or the FOS, it is likely this will be rejected unless you AMEND your grounds of complaint, to take on board the impact of recent developments, and explain why you are still entitled to a refund of unfair bank charges. There is no need to pay for anyone to help you do this - you can do this yourself, or with the free help or support of a community law centre solicitor, money advice agency or Citizens Advice Bureaux. Details of where to locate free help is set out below.

GLC has drafted the following downloadable example letters for use within the UK:

(1) Letter to bank with amended grounds of complaint:

| Word document link | htm link |

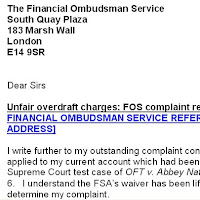

(2) Letter to the Financial Services Ombudsman with amended grounds of complaint:

| Word document link | htm link |

Use the following links to locate free help from a local advice agency in the following locations: glasgow; scotland; england & wales; northern ireland; ireland

It is understood (see the comment thread below) that the FOS has written to some people who have sought to amend their complaints, advising them that it is necessary to first put these 'new' grounds of complaints to the bank. This would effectively mean starting the complaint all over again. A suggested letter explaining why the 'amendments' are not 'new grounds' is here:

(3) Letter to FOS requesting a determination of the original complaint (as amended):

| Word document link | htm link |

There is no guarantee of success, however, we are encouraging UK consumers to insist upon their right to pursue a complaint with their bank and the FOS. If you are successful in obtaining a refund please let us know, by posting a comment below.MoneySavingExpert.com will be producing free updated guidance on how to reclaim unfair bank charges in the next week or so, so please sign up to the free MSE e-mail alert, for further details.

Tidak ada komentar:

Posting Komentar